BTC Price Prediction: 2025-2040 Outlook Amid Bullish Technicals and Macro Shifts

#BTC

- Technical Strength: BTC trades above 20-day MA with MACD bullish crossover

- Institutional Catalysts: Mining expansion and portfolio allocation trends

- Macro Risks: Regulatory actions may cause short-term volatility

BTC Price Prediction

BTC Technical Analysis: Key Indicators Signal Bullish Momentum

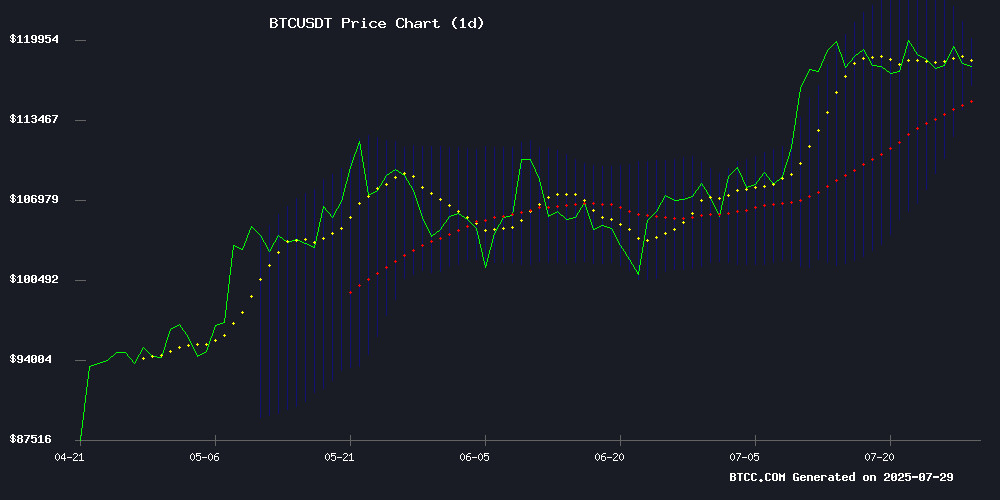

According to BTCC financial analyst William, Bitcoin (BTC) is currently trading at $118,636.28, slightly above its 20-day moving average (MA) of $118,228.09, indicating a potential bullish trend. The MACD histogram shows a positive crossover at 1,984.69, suggesting upward momentum. Bollinger Bands reveal price consolidation near the middle band, with resistance at $120,121.39 and support at $116,334.78. William notes, 'The technical setup favors buyers, but a decisive break above $120K is needed for sustained upside.'

Market Sentiment: Institutional Adoption and Regulatory Moves Shape BTC Outlook

BTCC's William highlights mixed sentiment amid bullish catalysts: RAKBANK's crypto trading launch and Bitmain's U.S. mining expansion counterbalance Coinbase's weakening demand. 'The Fed's potential rate cut and Ray Dalio's 15% portfolio recommendation could reignite institutional interest,' he states. However, the U.S. Treasury's $2.4M bitcoin seizure adds regulatory uncertainty. William concludes, 'Macro tailwinds outweigh short-term headwinds as BTC consolidates near $119K.'

Factors Influencing BTC’s Price

RAKBANK Launches Crypto Trading for UAE Retail Customers

RAKBANK, with assets totaling AED 88.3 billion, has broken new ground as the first conventional bank in the UAE to offer Bitcoin and other cryptocurrency trading services to retail clients. This strategic move accelerates the integration of digital assets into mainstream finance, positioning the UAE at the forefront of fintech innovation.

The bank's platform enables direct crypto trading, significantly lowering barriers to entry for everyday investors. By bridging traditional banking with digital asset markets, RAKBANK sets a precedent for institutional adoption in the region.

US Seeks $2.4M Bitcoin from Chaos Ransomware

The US government is moving to claim 20.2 BTC, valued at approximately $2.4 million, seized by the Dallas FBI from the Chaos ransomware group. These bitcoins, if forfeited, will be allocated to the United States’ Strategic Bitcoin Reserve—a national asset fund established in 2025 to hold confiscated bitcoin as a long-term store of value.

The reserve treats Bitcoin as a strategic financial asset, refraining from liquidating holdings to reinforce the country’s digital asset strategy. This approach underscores growing institutional recognition of cryptocurrency as a durable reserve asset.

Bitcoin Cloud Mining Gains Traction Amid BTC Price Surge

Bitcoin's price stability between $116,000 and $119,000, bolstered by Donald Trump's announcement of reduced US-EU tariffs, has reignited investor interest in passive income opportunities. Cloud mining platforms, particularly ZA Miner, are witnessing heightened demand as users seek alternatives to direct market participation.

ZA Miner distinguishes itself through a no-cost entry model, offering a $100 sign-up bonus and 24/7 customer support. The UK-based platform eliminates technical barriers, allowing users to earn daily mining rewards without active market monitoring. Its referral program further incentivizes adoption, with commissions up to 7%.

U.S. Moves to Seize $2.4M in Bitcoin Linked to Ransomware Group, May Add to Strategic Reserve

The U.S. Department of Justice has initiated a civil forfeiture complaint targeting 20.2 Bitcoin ($2.4 million) tied to a member of the Chaos ransomware collective—a cybercriminal network specializing in data encryption and extortion. The FBI's Dallas field office originally confiscated the assets in April 2025.

This seizure aligns with the Strategic Bitcoin Reserve (SBR) established by executive order in March 2025. The policy designates confiscated cryptocurrencies as long-term national holdings, reinforcing the U.S. position in digital asset leadership. Current estimates suggest federal agencies control at least 198,012 BTC ($23.54 billion), though decentralized accounting across the Marshals Service, FBI, and DEA obscures precise totals.

Bitcoin Faces Price Movement with Mixed Market Signals

Bitcoin recently tested a liquidity gap between $104,000 and $114,000 before retracting from its all-time high. Traditional capital outflows contrasted with sustained optimism in derivatives markets, highlighting a divergence that has captured analyst attention.

Spot market indicators showed buyer fatigue as the RSI dropped from 74.4 to 51.7, though recovering Spot CVD suggested demand returning at lower levels. Futures markets maintained $45.6 billion in open positions with elevated funding rates, signaling leveraged traders anticipate a rebound.

The options market reflected uncertainty with a 77% volatility spread surge despite shrinking open interest. The 25 delta skew's slight positivity indicates reduced panic hedging, leaving the market balanced between caution and opportunity.

Bitmain to Establish First U.S. Crypto Mining Facility in Texas or Florida

Bitmain, the dominant producer of cryptocurrency mining hardware, is expanding its operations to the United States. The company plans to open its first U.S.-based facility in either Texas or Florida, with production slated to begin in early 2026. The move includes setting up an assembly line and hiring 250 local workers.

The decision follows former President Donald Trump's call for Bitcoin to be "made in the U.S." Bitmain's expansion aims to mitigate supply chain disruptions and regulatory scrutiny faced by Chinese tech firms. Irene Gao, Bitmain's global business chief, noted that while U.S. labor costs are higher, the strategic benefits—such as faster delivery and repair times for American customers—justify the investment.

U.S. Customs and Border Protection delays and Commerce Department blacklisting of Chinese-linked firms like Sophgo have complicated Bitmain's operations. The company's Antminer rigs, currently manufactured in Southeast Asia, will soon have a stateside production hub.

Anthony Pompliano Predicts U.S. Bitcoin Purchase as Dollar Weakens

Anthony Pompliano, a prominent entrepreneur and investor, has suggested that the U.S. government may soon announce a Bitcoin purchase as inflation continues to erode the dollar's value. His comments come amid growing corporate interest in Bitcoin as a hedge against fiat currency devaluation.

The U.S. dollar has lost approximately 30% of its purchasing power over the past five years, prompting Pompliano to challenge corporate treasurers to reconsider cash-heavy balance sheets. "Public companies are destroying shareholder value by holding assets guaranteed to depreciate," he stated during a CNBC interview, advocating for Bitcoin adoption as a long-term store of value.

Bitcoin maintains its dominance as the preferred crypto asset for institutional adoption, with Pompliano predicting that balance sheet allocations – currently seen as contrarian – will eventually become market consensus. The cryptocurrency's finite supply and decentralized nature position it as a structural alternative to inflationary fiat currencies.

Coinbase Premium Turns Negative as U.S. Bitcoin Demand Weakens

Bitcoin faces mounting pressure as the Coinbase Premium Gap—a key indicator of U.S. institutional demand—flips negative for the first time since May. The cryptocurrency now trades at a discount on Coinbase relative to Binance, signaling diminished buying interest from American investors.

Historically, a premium on Coinbase reflected strong institutional activity due to the exchange's regulatory compliance and reputation. The reversal suggests caution among U.S. traders, compounded by slowing inflows into Bitcoin ETFs. Analysts warn of potential downside toward the $116,000-$118,000 support range if the trend persists.

CryptoQuant data underscores the pattern: previous negative premiums coincided with periods of U.S. investor reticence. With Binance now commanding higher prices, market dynamics may shift toward Asian trading volumes driving short-term price action.

Ray Dalio Advocates 15% Portfolio Allocation to Bitcoin or Gold Amid U.S. Debt Crisis

Billionaire investor Ray Dalio has significantly revised his stance on Bitcoin, now recommending a 15% portfolio allocation to either Bitcoin or gold. This marks a stark departure from his 2022 advice of just 1-2% exposure to BTC. The shift comes as U.S. national debt balloons to $36.7 trillion, with Treasury projections indicating $1 trillion in new borrowing for Q3 2025.

Dalio framed the move as essential risk management in what he terms a "debt doom loop" scenario. While maintaining his preference for gold, the Bridgewater Associates founder acknowledged Bitcoin's growing role as a hedge against fiat devaluation. "The return-to-risk ratio demands this adjustment," Dalio stated during his appearance on the Master Investor podcast.

Market observers note this endorsement carries particular weight given Dalio's previous skepticism. The recommendation signals institutional recognition of digital assets' maturation as store-of-value instruments alongside traditional safe havens.

Bitcoin Holds Steady Near $119K as Market Awaits Breakthrough

Bitcoin trades in a tight range around $119,000, with resistance looming at the $120,666 level. Market participants watch for a potential breakout, though the elevated Stablecoin Supply Ratio suggests limited fresh capital to fuel further gains.

The $120K–$122K zone remains a critical resistance area, with liquidation risks on both sides. Miner behavior and declining exchange reserves indicate reduced sell pressure, potentially setting the stage for upward momentum if key levels are breached.

A decisive move above $120,700 could propel Bitcoin toward $124K–$127K, while failure to hold $114,800 may trigger a reversal. The market's next move hinges on whether bulls can overcome this technical hurdle amid current liquidity conditions.

Fed Likely to Hold Rates, September Cut Could Boost Crypto

The U.S. Federal Reserve is expected to maintain interest rates at 4.25–4.5% amid subdued inflation pressures, as indicated by the latest GDP Deflator data. Market participants are now speculating about a potential rate cut in September, which could inject liquidity and bolster investor confidence in risk assets.

Cryptocurrencies, particularly Bitcoin, stand to benefit from such monetary easing. Historical trends suggest that looser policy expectations often catalyze rallies in digital assets, even as broader macroeconomic uncertainties persist.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and macroeconomic factors, BTCC's William provides these projections:

| Year | Price Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $150K-$180K | ETF inflows, halving aftermath |

| 2030 | $400K-$600K | Global CBDC integration, scarcity premium |

| 2035 | $800K-$1.2M | Network effect as reserve asset |

| 2040 | $1.5M-$2.5M | Full institutional adoption, supply shock |